Every business must be well informed for it to survive the competitive environment they operate in. One of the significant competencies they must have is developing and understanding vital financial statements. These are important reports for the businesses to ensure they can withstand competition in the market.

Importance of financial statements

Any business running without these important financial statements is like driving a car without a dashboard. Businesses need constant reports on various parameters such as capital costs, market share, demand, production costs among others. The most significant one is financial information such as salaries, loans, revenues, and investments.

Trial balance

To ensure the correct recording and storage of data, the trial balance is used. It allows the business to prepare information that can be utilized later to generate important financial statements. One way of collecting and storing business financial information is using the double entry method. The amount of money transacted by the business becomes a debit entry in one account and debit entry in the other. Therefore, each account will either have a debit or a credit balance.

A trial balance will then be the sum of all the general ledger accounts. It is generated at the end of the financial year. Listing of the balances will indicate whether the total of all credits is equal to debits. If the two don’t tally, it will call for investigations to determine the errors. It will also help in detecting any wrong entries or arithmetic mistakes. Once the errors have been rectified in such a way that the debits and credits are equal, financial statements are prepared.

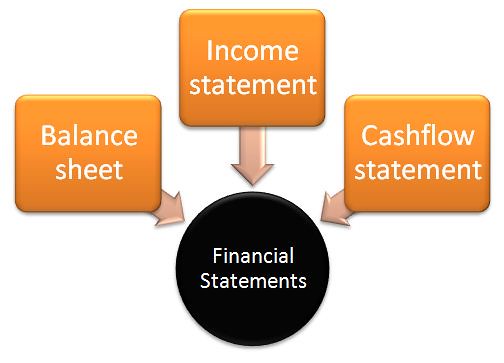

Types of Financial Statements

The two most important statements in a business are the profit and loss statement and the balance sheet. The balance sheet is the state of the business finances on a given day, usually the final day in the business’ financial year. It gives a picture of the business in terms of assets, equity, and liabilities. The balance sheet has to balance out the liabilities and assets in the financial statement.

On the other hand, the profit and loss statement (P&L) is the state of the business finances for a given period usually the business financial year. This helps the business assess its performance against the set objectives. Profits are made if the revenues are greater than the expenses or costs. If the revenues are less than the expenses or costs, then losses are made. The financial statements help stakeholders determine the financial health of the business. The reports also help the business in projecting itself in the market.

Its important to have accurate financial statements. Check this article out to explain why its so important.